There’s always a certain energy in the air as the year winds down. Families begin to reflect, professionals wrap up projects, and many people across Durham Region start planning what their next chapter could look like. For a lot of homebuyers, that reflection often leads to a bigger question: Is now the right time to buy? And more specifically, What’s happening with interest rates, and how does it affect my homeownership journey heading into 2026?

It’s a reasonable concern. Interest rates shape everything – monthly carrying costs, affordability, mortgage qualification and, ultimately, how far your budget can take you in places like Whitby, Oshawa, Pickering, Courtice, or Clarington. Rates influence not only what you can buy, but also how competitive the market becomes, which neighbourhoods rise in demand, and how confident buyers feel going into the offer process.

The good news? By late 2025, the interest-rate landscape in Canada has become far more stable than it was in the turbulence of recent years. Borrowers aren’t dealing with sudden spikes or uncertainty with every Bank of Canada announcement. Instead, the conversation has shifted toward what stability means – and how buyers can use it to their advantage heading into 2026.

We’ll break down exactly where interest rates stand today, how experts believe they will evolve, and most importantly, what that means for anyone hoping to buy a home in Durham over the next twelve months.

Where Interest Rates Stand Right Now

As of late 2025, the Bank of Canada’s policy rate sits at approximately 2.25%, a figure supported by multiple national trackers and economic forecasts. After a turbulent cycle of increases earlier in the decade, the country has entered a period of relative steadiness. For borrowers, that stability translates into predictable lending conditions and a mortgage environment that feels far more navigable than the one faced in 2022–2023.

What does this actually mean for homebuyers in Durham?

First, it means variable mortgage rates have calmed significantly. Borrowers aren’t seeing the rapid month-to-month changes that once made budgeting difficult. For many, this stability brings confidence – the ability to plan payments without fear that another rate announcement will shift everything overnight.

Second, fixed mortgage rates, influenced by bond yields and global economic conditions, have also become more predictable. There are still fluctuations, of course, but they’re more gradual. That consistency lets buyers make long-term decisions with less anxiety and more clarity.

And third, the qualification environment has become slightly more favourable. While the mortgage stress test still requires lenders to qualify you at a higher rate than your contract rate, the gap feels less daunting when actual rates remain stable. For many Durham buyers, this opens doors that may have felt closed even a year ago.

What Experts Predict Heading Into 2026

Forecasting interest rates isn’t an exact science, but most major financial institutions and economists agree on one thing: Canada is entering a period of moderation. Extreme hikes or cuts are unlikely unless the country experiences a dramatic economic shift. Instead, we’re expected to see the Bank of Canada maintain a path of stability, allowing inflation to gradually align with its long-term target.

For buyers, this matters more than you might think. Predictability is powerful. When interest rates behave consistently, the real estate market behaves consistently too. Buyers can make clearer decisions, and sellers can price homes more effectively. Durham Region, with its strong mix of family neighbourhoods, commuter appeal, and ongoing growth, often responds quickly to these patterns.

Many economists believe that if the rate moves in 2026, it will do so slowly and in smaller increments. That means your monthly mortgage payment is unlikely to swing dramatically in either direction. Instead of timing the market – something even experts struggle to do – buyers benefit from planning around expected stability and focusing on the broader picture: affordability, neighbourhood selection, and long-term value.

How Interest Rates Affect Durham Buyers Right Now

To understand how rates shape buying power, it helps to think beyond the number itself. Consider what a 0.50% shift actually means. On a typical Durham home purchase, that seemingly small increase can raise your monthly payment by enough to reduce your available budget by tens of thousands of dollars. Conversely, a small decrease can expand what you qualify for, allowing you to explore neighbourhoods or home types that previously felt out of reach.

What matters even more is how these numbers interact with inventory and competition. Durham remains one of the most desirable regions for GTA commuters and families looking for more space. Even when rates rose earlier in the decade, demand never disappeared – it simply moved, adjusting buyer behaviour. Today, with stability returning, that demand is resurfacing in more predictable ways.

Buyers who act in a stable rate environment often benefit from confidence. They know their budget, understand their payment, and can make stronger decisions without panicked urgency. When the market does shift – whether rates dip slightly or competition intensifies in spring – prepared buyers are already positioned for success.

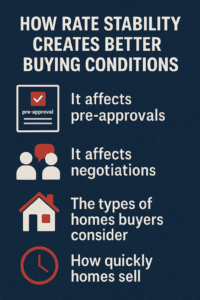

The Hidden Advantage: Rate Stability Creates Better Buying Conditions

Rate stability has a ripple effect across the entire home-buying journey.

It affects pre-approvals.

>It affects negotiations.

>It affects the types of homes buyers consider.

>It even affects how quickly homes sell.

When buyers know what to expect from lenders, they are less likely to hesitate – and hesitation is often what leads to missed opportunities. Stable conditions also mean buyers can work more closely with agents to explore emerging opportunities in Durham’s micro-markets: the up-and-coming pockets in Oshawa, the quieter family streets of Courtice, the increasingly competitive neighbourhoods across Pickering and Whitby.

Durham’s diversity is its strength. From lakeside communities to newer suburban developments, each area responds differently to shifts in borrowing costs. With stable rates, buyers can explore these neighbourhoods based on lifestyle rather than economic fear.

Practical Steps Buyers Should Take Before 2026 Arrives

The best strategy heading into 2026 isn’t to rush. It’s to prepare.

Buyers should begin by reviewing their budget with real numbers that reflect today’s rates – not assumptions based on older, lower-rate environments. Getting pre-approved is one of the most effective ways to understand where you stand. It takes the guesswork out of affordability and provides a clear framework for your home search.

Next, buyers should understand that a pre-approval is not just a financial exercise; it’s a strategic one. Once you know your lending range, you can explore Durham’s neighbourhoods more intentionally, focusing on listings in areas that offer real value and future growth potential.

Finally, buyers should build a cushion. Even in a stable rate environment, there’s always the possibility of a slight adjustment or change in lender offerings. Planning for a small buffer ensures you stay within a comfortable monthly payment range – a key factor in long-term financial stability.

What This All Means for the Future of Durham Real Estate

Durham Region continues to grow as one of the most sought-after markets outside the GTA. Its combination of affordability, transit access, school options, and community lifestyle. This is what makes it a consistent favourite for families, professionals, and first-time buyers. Interest-rate stability only strengthens this trend.

As we head into 2026, the market is expected to move at a steady pace. Homes that are priced well and located in popular neighbourhoods will continue to see strong interest. Homes that require updating or sit outside high-demand pockets may offer opportunities for buyers looking to get into the market strategically.

The common denominator is this: buyers who understand the rate landscape will enter the market with clear expectations and stronger negotiating confidence.

Final Thoughts: Knowledge Makes You a More Confident Buyer

Interest rates influence the real estate landscape, but they don’t dictate your future. What matters most is how well you understand the environment – and how prepared you are to move within it.

As we approach 2026, the Durham real estate market is shaped less by fear and more by opportunity. Stability in interest rates gives buyers room to breathe, plan, and pursue the homes that truly fit their needs.

If you’re considering buying in Durham and want to understand how current rates affect your budget, Bold Group is here to guide you. We’ll help you navigate the numbers, explore neighbourhoods with long-term potential, and move toward homeownership with clarity and confidence.